Personal debt has become an epidemic in the United States. In fact, 1 in 3 Americans will have a debt that is in collections this year. Today, Americans have over $2 trillion in consumer debt including over $800 billion in credit card debt. While being a debtor is not uncommon, the effects of being buried in debt are severe. Some people ignore the effects of debt on the individual until it is too late. Debt has been well documented as a leading cause of divorce, difficulty in maintaining a career, and even contributing to health problems.

Debt and your relationships

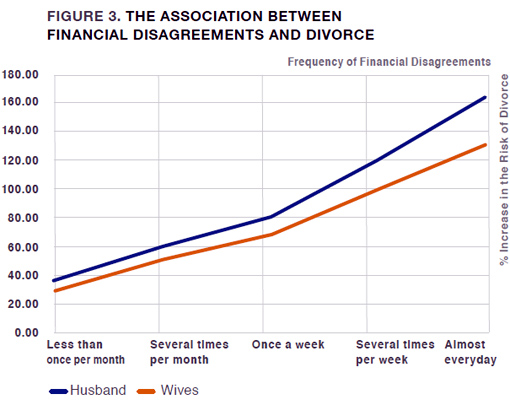

Couples who are in debt are much more likely to file for divorce than couples with a stable financial outlook. CNBC recently finished a study finding that money is that number one cause of stress in marriages.[1] In another 2012 survey, respondents reported that arguments about finances were more common than any other issue.[2] The stress from financial troubles further becomes a leading cause of marriages ending. In fact, the frequency that couples disagree about money correlates to the likelihood of divorce.

Debt and your Career

Personal debt problems can also damage your career options. First, debt is one of the largest causes of stress for Americans and is well-documented to effect your work productivity. Even more directly, debt collectors routinely contact the employers of persons they are trying to collect a debt from. These unwanted calls at work can be embarrassing and damaging to your career. Finally, more employers review credit reports as part of their background checks for potential new hires. When an employer or potential employer finds a history of late payments, unpaid debts, judgments or defaults, an employer is likely to have a more negative view of the potential employee. If employers find that you suffer from serious debt issues, you ability to progress with your current employer, or to join a new employer, could be put in danger.

Debt and your Health

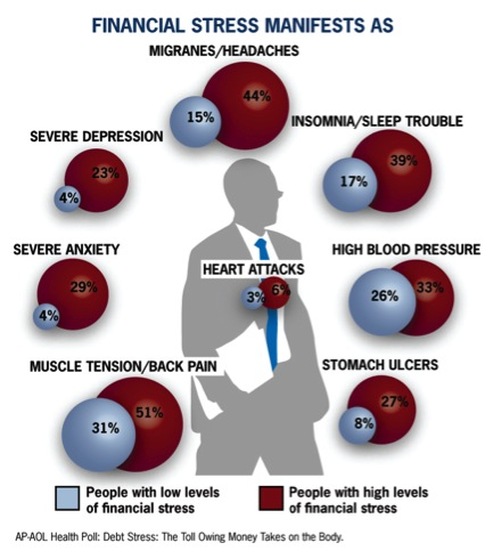

Overlooking the stress caused by debt problems can be physically dangerous. Financial stress is commonly manifested as the root causes for a number of health problems including serious conditions as ulcers and heart attacks. According to the American Psychological Association, 73% of Americans say that debt is a significant source of stress in their lives. The serious health problems associated with financial stress is widespread and so severe that it has even been increased with a increase in death from high blood pressure, stroke and heart attack. In Canada, the health consequences of financial stress have become so severe that researchers and health professionals are pushing to treat personal debt as a public health problem.

Debt can wreak havoc on every area of your life including your relationships, your career and your health. Debt is not a problem goes away when it is ignored. Not addressing small debt issues, leads to larger debt issues. Larger debt issues that are not addressed can bury people and destroy families. Many people understand that their debts are dangerous but just don’t know what to do because they do not have extra money to pay down the debt and don’t understand what debt recovery options best suit their case. Today, there are a myriad of different debt recovery techniques that can be used in different situations, but are difficult for many people to understand which techniques they should choose.

This article contains material of general interest and should not be construed as legal or financial advice or a legal opinion on any specific facts or circumstances. This content may not be relied upon as personal, legal, or financial advice. This article does not include legal advice and does not create an attorney-client relationship. If you need legal advice, please contact an attorney directly.

[1] https://www.cnbc.com/2015/02/04/money-is-the-leading-cause-of-stress-in-relationship

[2] : http://www.dailymail.co.uk/femail/article-2155480/Till-debt-How-money-issues-cause-arguments-children-chores–end-divorce.html#ixzz4xg7iPiKR